As a part of the ongoing SM Entertainment civil war, Lee Soo Man recently entered his sad boi era in response to sweeping allegations by SME CEO Lee Sung Soo about his handling of the company, and now Dispatch has reported further on Lee Soo Man’s shady financial dealings.

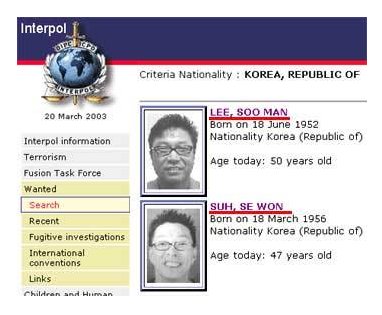

In a 118-point article, the outlet followed the history of financial impropriety by Lee Soo Man. They started from the beginning as well, with what got him wanted by INTERPOL to begin with.

Many know that picture, but don’t know the history behind it. Basically, SME wanted to be listed on the KOSDAQ in 1999 but they didn’t have the capital for it … so LSM took care of that.

3. At that time, the requirement for being listed was ₩1.00 billion KRW (about $775,000 USD) in capital. But in 1999, SM Entertainment’s capitalization was only ₩50.0 million KRW (about $38,800 USD).

4. SM Entertainment had to increase their capital. They needed money. To do this, the company issued new stocks, increasing their capitalization to ₩1.15 billion KRW (about $892,000 USD).

5. Lee Soo Man had his hand in company funds. He withdrew ₩900 million KRW (about $698,000 USD) from SM Entertainment’s account and ₩250 million KRW (about $194,000 USD) from SM Enterprise’s account.

6. Lee Soo Man used this money to pay for the ₩1.15 billion KRW (about $892,000 USD) needed to increase the company’s capitalization.

7. In other words, it was a disguised payment.

8. Lee Soo Man took the money out of SM Entertainment and put it back into SM Entertainment.

9. SM Entertainment’s take off came from Lee Soo Man’s embezzlement.

“A capital increase is used to attract funds from outside investors into the company. However, in the case of disguised payment, no new money actually entered the company. He took the money out from the company and put it back in, making a net zero. This is an act of deceiving investors as if the company attracted an investment. This is basically fraud.” – Stock exchange official

Lee Soo Man was then put on INTERPOL’s wanted list in January of 2003, he surrendered back in Korea in May of 2003, and was sentenced to three years probation with a two-year stint should he violate the terms.

14. Dispatch was able to secure the documents sharing the court’s ruling at the time.

“Lee Soo Man embezzled ₩1.15 billion KRW (about $892,000 USD) in company funds and used them to buy shares in the company. He pretended to pay for the shares without proof of actually using the capital but it was reported as if the total capital of the company had increased. Due to the serious nature of the crime, a punishment corresponding the severity of the crime is inevitable.” – Court ruling

15. But wait, what was Lee Soo Man’s position on this? There was a “shield” defending him.

“Lee Soo Man is not the only one who took money from the company. He did not do this on his own. It was decided at a meeting between the executives of the company and Lee Soo Man took the reigns. Also, he paid back the amount right away.” – Lee Soo Man’s “shield”

Lee Soo Man basically pointed fingers at the company, but an exec from the time denied that was ever the case.

16. Dispatch was able to secure a conversation with a person who was an executive at SM Entertainment at that time.

“There was a disguised payment made for the purpose of getting listed on the stock exchange. We didn’t hold a board meeting. The meeting notes were just hastily made at the attorney’s office. Everything was done under Lee Soo Man’s direction. When the investigation began, Lee Soo Man hurriedly paid back the rest of the money.” – Former SM Executive “A”

The point of that was to essentially establish that LSM built SME on the back of these types of financial maneuverings, and as such nothing that follows should be surprising.

The article then goes into how the stock listing made his parents rich due to them owning part of the company beforehand, which they sold off later once the stocks rose. It also describes Lee Soo Man’s continual selling of stock at a high price and then issuing new stocks so he could buy back SME stocks at a cheaper price.

32. On November 24, 2005, Lee Soo Man sold 800,000 shares during after-hours trading. The price per share was ₩13,300 KRW (about $10.30 USD), totaling ₩10.6 billion KRW (about $8.22 million USD).

33. Two months later, SM Entertainment conducted a paid-in capital increase related to shareholder allocation. Paid-in capital increase refers to a company raising money by issuing stock to investors. Lee Soo Man was allocated 673,741 shares. The price was ₩9,020 KRW (about $6.99 USD), worth a total of ₩6.10 billion KRW (about $4.73 million USD).

34. With this maneuver, Lee Soo Man became a genius.

35. He sold his shares at a value of ₩13,300 KRW (about $10.30 USD). But the shares were re-introduced at a price of ₩9,020 KRW (about $6.99 USD).

In the end, it’s estimated that Lee Soo Man will have made ~$350 million dollars on the stock exchange, including the latest HYBE sell-off.

Amazingly, that doesn’t even include the long controversial affiliate companies under Lee Soo Man’s control, with Like Planning being particularly notable but SM Enterprise factoring in as well.

47. In April 2000, Lee Soo Man released shares of SM Entertainment to the public. Like Planning and SM Enterprise were affiliate companies to SM Entertainment.

48. Dispatch took a look at the company introduction that SM Entertainment submitted to the stock exchange.

49. “SM Enterprise is the management company for our artists. SM Entertainment pays 20% of the album sales of our artists to SM Enterprise as commission.” – SM company introduction

50. .”Like Planning is in charge of music consultation and production of SM’s artists. SM Entertainment pays 15% of the album sales to Like Planning as commission.” – SM company introduction

This was basically his cash flow money, where he got commission of up to a fifth of revenue, not profits.

From Like Planning, he’s estimated to have made ~$135 million over the years. And early on he had SM Enterprise operating from 2000-02, which made him ~$5 million.

88. The money sent to SM Enterprise totaled ₩5.96 billion KRW (about $4.62 million USD) over three years: ₩2.78 billion KRW (about $2.15 million USD) in 2000, ₩2.13 billion KRW (about $1.65 million USD) in 2001, and ₩994 million KRW (about $771,000 USD) in 2002.

~6% of SME’s total sales were taken by Lee Soo Man under the justification as licensing costs, and he sent out people like Lee Sung Soo to justify this by claiming that Lee Soo Man was the only one that could provide the value necessary to make the company successful, and thus he deserved it.

Right.

Now this obviously impacted stock prices, as reports would frequently show the company barely making a profit or in the red at times. They later talk about exactly how bad this was for investors.

117. What if the company put shareholder interests first? SM’s price-to-earnings ratio would have been at least 25 times more that it was.

But Like Planning being disconnected from SME recently is not the end of Lee Soo Man’s involvement, as Dispatch describes CT Planning as “Like Planning Season 2”.

91. In 2019, Lee Soo Man formed CT Planning Limited in Hong Kong.

92. CT Planning Limited was Lee Soo Man’s logic and counter. A place where 6% of sales can be deducted from overseas and logically, 6% of sales can be justified in Korea.

93. SM Entertainment launched SuperM globally in 2019 in partnership with Capitol Music. In 2022, aespa was introduced to the United States’ market alongside Warner Records.

94. Lee Soo Man is known to have asked both companies for 6% of the sales under the guise of production fees.

95. According to Lee Sung Soo, the licensing cost of 6% of sales was sent to Lee Soo Man’s overseas company, CT Planning Limited. This was tax evasion.

These are the deals Lee Sung Soo was talking about in his video, in regards to whether HYBE knew of this or not.

In total, Dispatch estimates that Lee Soo Man has made about $580 million from SME over 23 years.

101. How much money did Lee Soo Man take out of SM Entertainment’s wallet?

102. His remaining stocks, 868,948 shares, were calculated at the closing price of ₩132,000 KRW (about $102 USD) as of February 16, totaling ₩115 billion KRW (about $89.2 million USD). He got ₩173 billion KRW (about $134 million USD) from Like Planning and ₩5.90 billion KRW (about $4.57 million USD) from SM Enterprise.

103. Lee Soo Man took ₩744 billion KRW (about $577 million USD) from SM Entertainment over a span of 23 year

To conclude, they point out the irony of SME’s executives making the most out of the Big 3 despite having the lowest profit ratio.

116. SM’s operating profit ratio is the lowest amongst the big 3 of SM, JYP, and YG. However, the payment for the company’s directors is the highest. The irony.

The implication of this, I think, is that they are/were being compensated for not saying anything about Lee Soo Man allegedly embezzling funds.

Also, credit where it’s due, Dispatch came up with this killer summation of Lee Soo Man’s relationship with SME execs.

107. Lee Soo Man opened his mouth. And SM Entertainment’s past and present executives put the pie into his mouth.

Honestly, things do get rather cult-ish when you get down to the details and justification for allowing Lee Soo Man to get away with the things he did for so long.

——

So this is effectively Lee Sung Soo’s side of the dispute, which is that Lee Soo Man has for too long been using SME to enrich himself (potentially illegally) to the detriment of investors and probably everybody involved with the company, since their profitability likely impacts wages and contracts and who knows what else.

How much of this is actually illegal and could be proven in court? Don’t know, but embezzlement and tax evasion investigations are nothing new for the company, and nothing has really come of it so far, so I don’t expect much to come of this either.

While I wouldn’t say it’s necessarily a shock to hear that Lee Soo Man and/or SM Entertainment and/or their executives have been doing shady business, it is somewhat rare to get an itemized account of the fuckery involved. Really that’s one of the benefits of this whole mess, that more and more shit continues to come out and it reveals the inner workings of companies like this.

Asian Junkie Asian pop. Without discretion.

Asian Junkie Asian pop. Without discretion.